By Mazi. Godson Azu, a Political Analyst at C&M Centre for Leadership and Good Governance UK.

Understanding how a political party ideology can influence a country’s economic direction in modern society in view of the center-right and left divide.

In modern society, both in developed and developing countries around the world, with a defined democratic setting, civil rules and ethical values, should have political party’s with ideology frameworks, principles and direction, particularly whether it aligns with the center-right or left, even to an extent to the far-right or left of the political spectrum, this ideological identity can strongly influence a country’s socioeconomic direction, either driven by the market or strict government dictates.

What is the emerging neoliberal or neorealist political thinking implied by many developed and stable democratic countries, which has enabled them to pilot the affairs of governance with the common interest of nation-building and economic development?

Center-Right:

- Emphasis on free-market principles, limited government intervention, and individual economic freedoms.

- Favors deregulation and tax cuts to stimulate business and economic growth.

- Often promotes fiscal conservatism, aiming for a balanced budget and reduced government spending.

- Believes that a thriving private sector is essential for overall economic prosperity.

Centre-Left:

- Advocates for a more active role of government in the economy to address social inequalities.

- Supports progressive taxation, social welfare programs, and regulations to protect workers and consumers.

- Focuses on reducing income inequality through wealth redistribution policies.

- Prioritizes public services, education, and healthcare as essential components of a just and equitable society.

The divide between these ideologies, as strategically strengthen the democratic system, political debate, a conservative and resourceful opposition movement in governance, which is highly critical of any form good governance and leadership Either ideological framework should reflect the identity of a political party in power or in opposition, as the ideology influences decisions on issues like taxation, social safety nets, business regulations, and public-private investments. Thus, striking a balance between these perspectives often becomes a central challenge for policymakers, attempting to address both economic growth and social equity.

What is the difference between Neoliberal Capitalist economy and Neoliberal socialist economy?

The terms “Neoliberal Capitalist” and “Neoliberal Socialist” may appear contradictory as neoliberalism typically aligns more with capitalist principles. However, let’s break down the potential meanings for the simple purpose of many loss-end political traders in the Nigeria political minefield, who has taken politicking to the marketplace, rather than to parlance of governance.

Neoliberal Capitalist Economy:

- Emphasizes free-market capitalism with minimal government intervention.

- Advocates for privatization, deregulation, and the belief that a laissez-faire approach to the economy leads to efficiency and prosperity.

- Supports individual freedoms and choices in the market, often with an emphasis on reducing the role of the state.

- With the ever-increasing dilution and debate about the conception and imposition of Neoliberal capitalism and its economic consequences from the western developed capitalist to the rest of the world emerging economies, after the second world wars, and the anticipated collapse of capitalism, with the misconceived privatization and marketisation of public utilities, such as Energy, Water, Transport, Health, Education, Roads, and Communications, through Corporations ownership. It has been argued that the phrase, Neoliberalism has often concealed more intentions, than it elucidate, “The Market “which sounds more like a natural system, that tend to bear upon us equality, like a gravity or atmospheric pressure, that is highly fraught with power relations. In reality neoliberal capitalism evolves around what the market wants, which tends to mean, what the big corporations wants, just as Andrew Sayer noted in, “why we can’t afford the rich”, he stated that investment in its true form means two different things, One is the funding of productive and socially valued opportunities, the other is the purchasing of existing assets and then milk them for rent, interest, dividends and capital gains. So therefore, using same word for different actions, amounts to “Camouflaging the source of wealth “, hence leading to the confusing of wealth extraction, with wealth creation in real time understanding.

Neosocicalism Economy (if such a term is used): In other words (Mixed Economy).

- This phrase seems paradoxical because socialism tends to involve collective or state ownership of means of production, which contradicts neoliberal principles.

- It’s possible that someone might use this term to describe a system that combines certain neoliberal market-oriented policies with some socialist principles, defining a mixed economy system. One strong belief of the Neo-socialism ideology is that the failure of capitalism has resuscitated the need for a framework between government and business, this new idea of partisanship is believed to be inherently fairer to the greater number of people in the society. The belief that competition isn’t necessarily bad, in essence government can and should be allowed to compete with the private sector in the open market.

This brings to the forefront the notion of mixed economy, and according to Oxford Reference; A mixed economy is an economy with a mixture of both state and private enterprises, while some economic activities are carried out by individuals or firms taking independent economic decisions, determined by the market; other economic activities are carried out by organisations under state ownership and control, with some degree of centralised decision making, obviously most notable economies are mixed to a certain extent, such as; in Iceland, France, United States, United Kingdom, Russia, China, India and Sweden.

It is crucial to note that neoliberalism is traditionally associated with capitalist economic policies. The “neoliberal socialist” term might be used to describe a system that attempts to blend aspects of both ideologies, thus it’s not a widely recognized or coherent economic concept, but in most cases, it’s seen in the context of a mixed economy contestation. The ideologies of neoliberalism and socialism typically represent distinct approaches to economic organization and governance.

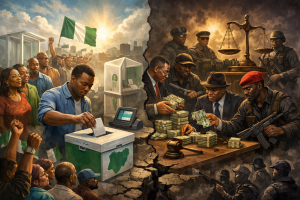

The reason for this postulation is the concern about the political ideological structure of Nigeria political party system, and their ailment with current realities of socioeconomic dynamics of national and regional challenges. In the past twenty-three years of the current democratic dispensation, we have seen one big political party, PDP a self-ascribed, conservative, neoliberal capitalist driven party, that misconceived the concept, to a Neopatrimonialism, a “ patron-client relationship, through which many public institutions were more or less handed over to cronies who acted as corporations, extracting wealth for the few, at the mercy of a government system propagating an enabling environment for equal opportunity and wealth creation. The party for sixteen years had greater opportunity to redefine and rebuild the country as a democratic nation shaped by its ideological values and economic dynamics, but unfortunately the party as an organ and or vehicle to arrive at a destination, was misused by political elements who never understood the conception, birth and philosophy of the party, but only saw it as a good vehicle to board with the intention of arriving at the planned destination. The PDP rule has been able to show many meaningful observing Nigerians, how at different periods of governance, they were able to propagate socioeconomic policies and implementation of such in line with neoliberal capitalism, most especially with the reform of the energy/power sector, the communication sector, the education sector, which has attracted an overwhelming competition between public institutions and private entities. While the PDP were struggling to balance its ideological strands with the emerging realities on ground, a new political phenomenon emerged, a determined merger of few political movements into a strong opposition party, with the matrix, “The Progressives”, flooded the political market with its slogan and symbol of change, riding on a complexity of political ideological directions, not two if they center-right conservative, or center-left socialist, as the merger consist of merry-go-round political elements, as a result of it complex formation, the change arose on how to ascribe the party beyond just been tagged a group of progressives, in reality this fragile entity soon became a very huge threat to the survival of the ruling party, as they mounted reactive propaganda campaigns, that eventually brought it to power in 2015. Then the reality of governance set-in, a so-called propaganda “Progressive” party, without an informed progressive socioeconomic policy direction, for good eight years in government, the APC, was not able to prove if the ran a neoliberal socialist, (Mixed Economy) in alternative to the PDP neoliberal capitalist economy, or they borrowed a leave-in-absence, because all the policies instituted by the APC, were mostly centered on neopatrimonialism, patron-client relationship, even more further than the PDP, as it revolved more around ethno-nationalist agenda. Currently, under the same government of the APC, progressive mantra, the party, and its leadership are yet to signpost Nigerians to a definite political and or economic ideological alignment, the president recently presented the 2024 budget of Renewed Hope, which does not clear indicate it’s either market driven or socially mixed economy in its entirety. It all comes down to the fact that as an unorganized orthodox polity, the country and its democratic transition process has still been driven by a few people in the political field, that only understand political gains, rather than an understanding of the citizen’s needs, and wants. There is an urgent need by this government of continuum, to re-strategies, decongest, and re-inject an ideological driven approach in its policy formation, decision-making and radical interventions to the socioeconomic challenges. I think the leadership should, listen and watch the dynamic in a positive change of governance based on ideological alignment, with the newly elected Argentina center-right President and his radical reforms on economic policy and social justice.

What are the economic indicators that attract investors and drives investment confidence?

In every advanced society around the world, their economy and social structure are driven by various forms of investment both foreign, domestic, direct, and indirect to stimulate the budgetary provisions and growth. There are several economic indicators that can play a crucial role in attracting investors and drive investment confidence.

Some of these key indicators include:

1. Gross Domestic Product (GDP):

- Indicates the overall economic health and size of a country’s economy.

2. Inflation Rate:

- Low and stable inflation is generally favorable for investment as it ensures the preservation of purchasing power.

3. Interest Rates:

- Moderate and stable interest rates can stimulate investment by making borrowing more affordable.

4. Unemployment Rate:

- A lower unemployment rate often suggests a healthier economy, increasing investor confidence.

5. Political Stability:

- Stable political conditions reduce uncertainty, making a country more attractive to investors.

6. Government Debt Levels:

- Lower levels of government debt is generally seen as positive, indicating fiscal responsibility.

7. Trade Balance:

- A positive trade balance can reflect economic competitiveness and attractiveness to foreign investors.

8. Infrastructure Development:

- Robust infrastructure signals a conducive environment for business operations.

9. Rule of Law and Regulatory Environment:

- Strong legal frameworks and transparent regulations enhance investor confidence.

10. Currency Stability:

- A stable currency reduces exchange rate risks, making investment more predictable.

11. Technological Advancements:

- A country investing in and adopting new technologies is often seen as forward-thinking and attractive for investors.

12. Consumer Confidence:

- High levels of consumer confidence can indicate a strong domestic market appealing to investors.

Investors are opportunity and risk takers, and as such typically assess a combination of the above indicators to gauge the overall economic environment and potential risks and returns. A favourable combination of these factors can contribute to increased investment confidence in a particular country or region.

Examining the prevailing economic indicators in Nigeria, including GDP, interest rates, and inflation rates, among others, raises the crucial question of whether the country is genuinely open to foreign and diaspora direct investments. In assessing the economic landscape, key factors such as GDP ratios, interest rates, inflation rates, government debt, political stability, infrastructure deficits, rule of law, currency stability, technological innovations, and the level of consumer confidence come into focus.

Firstly, Nigeria’s GDP ratios have seen fluctuations, influenced by factors such as oil prices, production levels, and global economic trends. This volatility may impact investor confidence, especially those seeking stable long-term prospects. Similarly, interest rates play a pivotal role in attracting or deterring investments. If rates are too high, it can impede borrowing and discourage investment, while excessively low rates may pose risks of inflation and economic instability.

Inflation rates in Nigeria also play a critical role in shaping the investment climate. Persistent inflation can erode the real value of investments, impacting returns and deterring investors. Furthermore, government debt levels are crucial indicators of fiscal health; high levels may raise concerns about sustainability and the government’s ability to meet financial obligations.

Political stability is a cornerstone for attracting investments. Investors seek environments with predictable political landscapes, where changes in leadership do not lead to abrupt policy shifts or uncertainties. Infrastructure deficits, including inadequate transportation and energy systems, pose challenges to potential investors, requiring substantial commitment to address these gaps.

The rule of law is fundamental for investor confidence. Legal frameworks that protect property rights, ensure contract enforcement, and guarantee a fair dispute resolution process are essential elements for a conducive investment environment. Currency stability is also vital; fluctuations can introduce uncertainties and risks for investors, affecting the overall attractiveness of the market.

Technological innovations and advancements contribute to a vibrant economic landscape. Countries embracing and fostering technological growth tend to attract forward-looking investors. Finally, consumer confidence levels reflect the population’s belief in the country’s economic prospects, influencing spending patterns and investment decisions.

Despite potential challenges in several indicators, investors may still be drawn to Nigeria for various reasons. Political exigencies, such as promising reforms or strategic geopolitical considerations, could be influencing factors. Additionally, the vast market potential, abundant natural resources, and a youthful population may contribute to investor interest.

Nigeria faces challenges in multiple economic indicators, there seems to be a nuanced balance attracting investors. Political exigencies, the promise of reforms, and the country’s inherent economic potential may explain the continued influx of investors. However, a challenging need for serious and intent long-term commitment to addressing the identified issues is crucial for sustainable industrialization and mass production of goods and services.

How can policy uncertainty affect investors’ investing and confidence?

Policy uncertainty can significantly impact investors’ decisions and confidence in several ways:

1. Risk Aversion:

- Investors may become more risk-averse in the face of uncertainty, leading to a reluctance to make new investments or expand existing ones.

2. Delayed Investment Decisions:

- Policy uncertainty can cause investors to delay important investment decisions until there is more clarity, potentially slowing down economic growth.

3. Volatility in Financial Markets:

- Uncertain policies can contribute to increased volatility in financial markets as investors react to changing expectations and unknown outcomes.

4. Impact on Long-Term Planning:

- Investors often engage in long-term planning. Policy uncertainty makes it challenging to predict future conditions, making it difficult for investors to plan and allocate resources effectively.

5. Reduced Business Confidence:

- Uncertainty in government policies may erode business confidence, affecting corporate investment and expansion plans.

6. Foreign Direct Investment (FDI) Impact:

- Foreign investors may hesitate to commit capital to a country with uncertain policies, impacting the inflow of foreign direct investment.

7. Capital Flight:

- Policy uncertainty may lead to capital flight as investors seek more stable and predictable environments for their investments.

8. Higher Cost of Capital:

- Increased uncertainty can raise the perceived risk associated with investments, leading to higher capital costs for businesses.

9. Job Creation Concerns:

- Businesses may be hesitant to hire and expand if they are uncertain about future policy directions, impacting job creation.

10. Shifting Investment Preferences:

- Investors may shift their preferences towards more stable regions or asset classes during periods of policy uncertainty.

The government in Nigeria must find means of reducing policy uncertainty through clear communication, stable governance, and consistent policy frameworks, which can help create a more favorable environment for investors, fostering confidence and supporting economic growth. The key element here is information sharing and dissemination, there is a serious need to be percussive in projecting the image of the country at all levels of media engagement or exposure, Nigeria is larger than any single or collective individuals, as such most be branded, presented with all sense of dignity and passion.

The role of principled leadership, with a decisive political will in governing a stable and progressive country. A Principled leadership with a decisive political-will plays a pivotal role in the directing and governing a stable and progressive country.

An effective leadership inspires, motivates, and guides individuals and groups toward common goals. Governance, on the other hand, ensures that systems and institutions operate fairly, transparently, and in the best interest of the greater number of the people. Together, they play a pivotal role in fostering a flourishing and ever-changing society. A principled leader most have and showcase the following qualities and characteristics for a successful good governance system.

1. Clarity of Vision:

- Principled leadership provides a clear vision for the future, outlining goals and priorities that guide the nation toward stability and progress.

2. Consistency in Policies:

- A principled leader maintains consistency in policies, offering predictability that fosters confidence among citizens and investors.

3. Effective Decision-Making:

- Decisive political will ensures prompt and effective decision-making, addressing challenges and seizing opportunities for the country’s advancement.

4. Rule of Law and Accountability:

- Principled leadership upholds the rule of law and promotes accountability, establishing a foundation for a just and stable society.

5. Inclusive Governance:

- A principled leader emphasizes inclusivity, considering diverse perspectives and ensuring that policies benefit the entire population.

6. Transparent Communication:

- Open and transparent communication builds trust between leaders and citizens, reducing uncertainty and contributing to a stable political environment.

7. Economic Stability:

- Decisive political will is essential for implementing sound economic policies, fostering stability, and creating an environment conducive to sustainable growth.

8. Infrastructure Development:

- Principled leadership prioritizes infrastructure development, laying the groundwork for economic progress and improved quality of life for citizens.

9. Social Cohesion:

- Leaders with political will work to foster social cohesion by addressing social inequalities and promoting unity, contributing to stability.

10. Global Standing:

- A principled leader can enhance a country’s global standing by engaging in constructive international relations and diplomacy.

11. Adaptability and Innovation:

- Principled leaders encourage adaptability and innovation, ensuring the country remains competitive in a rapidly changing world.

12. Crisis Management:

- During times of crisis, decisive political will is crucial for effective crisis management, instilling confidence in citizens and the international community.

In essence, principled leadership, coupled with decisive political will, creates a governance framework that not only navigates challenges effectively but also sets the stage for sustainable progress and prosperity, in a real world this is what Nigeria and Nigerians duly deserve to achieve, if governance is going to be examined and evaluated by the actual impact of government policy directions and actions, base on the principles of opportunity cost, leaders needs to forgo their personal interests, quest for self-wealth accumulation and power grid, in order to satisfy the actual and immediate needs and wants of the greater of number of the people of Nigeria.

Mazi. Godson Azu is writing from the UK, he is a political analyst, author, trade, and investment facilitator and the Director at C&M Centre for Leadership and Good Governance.