Comprehensive Report

Survey on President Tinubu’s 2025 Budget of Restoration

Introduction

The 2025 Budget of Restoration, proposed under the leadership of President Bola Ahmed Tinubu, aims to address Nigeria’s economic challenges while fostering sustainable development and social welfare. The budget focuses on reducing inflation, boosting oil production, and implementing the New Tax Reform Bill to enhance revenue generation.

To evaluate public perception and diaspora engagement with this budget, the C&M Centre for Leadership and Good Governance conducted a survey targeting the Nigerian diaspora. This report captures the findings, highlighting respondent demographics, awareness, perceptions of key budgetary goals, and actionable recommendations.

Executive Summary

The survey revealed high levels of awareness of the 2025 Budget of Restoration among the Nigerian diaspora, with varying levels of understanding of its specifics.

Key Findings

- Awareness: Broad awareness of the budget, but limited understanding of its priorities and implications.

- Skepticism: Concerns about achieving key targets such as inflation reduction and oil production goals due to implementation and economic realities.

- Engagement Gaps: Strong desire for deeper engagement and representation in national policy-making.

- Recommendations: Emphasis on transparent governance, anti-corruption measures, and investments in infrastructure, food security, and industrial development.

This report consolidates these findings and provides targeted recommendations to enhance the budget’s impact and inclusivity.

Aims and Objectives

The survey sought to:

- Assess awareness and understanding of the 2025 Budget of Restoration among the Nigerian diaspora.

- Evaluate perceptions of key budgetary priorities, including tax reform, inflation targets, and oil production goals.

- Explore the human-oriented nature of the budget and its alignment with grassroots needs.

- Identify recommendations for improving the budget’s effectiveness and fostering diaspora-government collaboration.

Survey Methodology

The survey employed a mixed-methods approach, combining quantitative and qualitative responses.

Key Elements

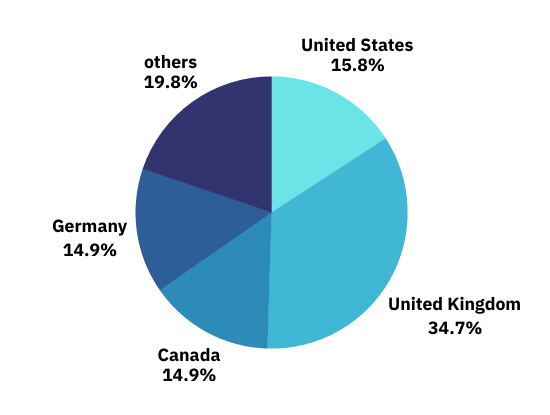

- Sample Population: Nigerian diaspora members, predominantly residing in the UK, with representation from Europe, Africa, and the United States.

- Data Collection: An online survey distributed via targeted networks, accessible to professionals, academics, and other diaspora stakeholders, with over 2 million registered members across continents.

- Demographics: Participants aged 45 and above, including entrepreneurs, academics, self-employed individuals, and pensioners.

Results

1. Respondent Demographics

- Country of Residence: Majority in the UK; smaller representation from Africa, Europe, and the US.

- Age Groups: Predominantly 55+ years old, followed by 45–54.

- Gender: Majority male respondents.

- Profession/Occupation: Diverse mix of entrepreneurs, consultants, pensioners, and academics.

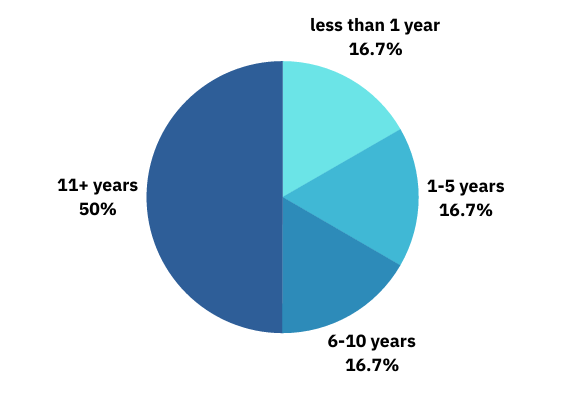

- Duration Abroad: Most respondents have lived outside Nigeria for over 11 years, reflecting deep-rooted diaspora connections.

2. Awareness and Understanding of the Budget

- Awareness: High awareness levels; primary information sources were Nigerian news platforms and social media.

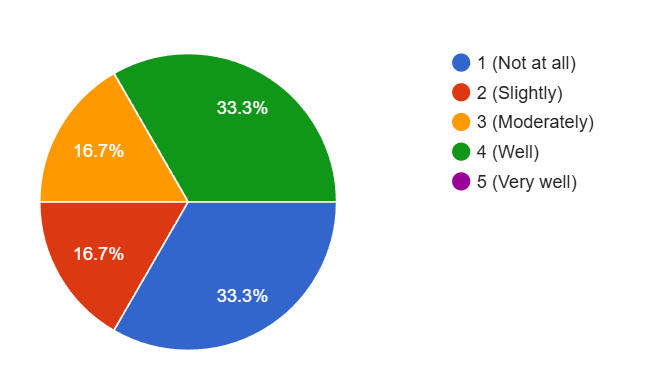

- Understanding: Most respondents rated their understanding as “Slightly” (200) to “Moderately” (300) on a scale of 1 to 5.

3. Perceptions of Key Budget Goals

- New Tax Reform Bill: Mixed views; uncertainty about alignment with expectations.

- Inflation Target: Skepticism about reducing inflation to 15%.

- Oil Production Goals: Responses ranged from cautious optimism to uncertainty about achieving 2 million barrels per day.

4. Human-Oriented Nature of the Budget

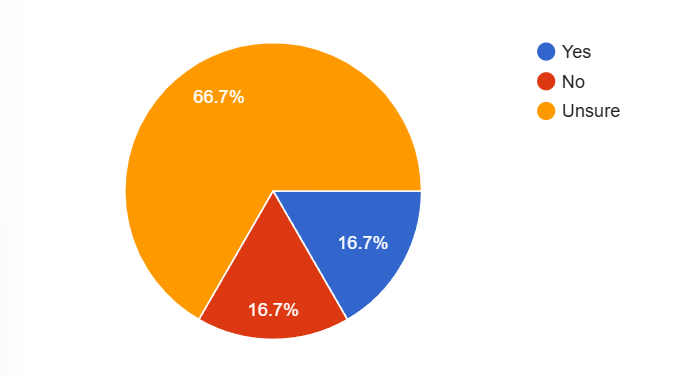

- Opinions: Polarized views:

- Some viewed it as addressing citizens’ needs.

- Others felt it lacked grassroots inclusivity.

- A significant portion remained unsure.

5. Role of Constituency Projects

- Relevance: Divided opinions on the importance and efficiency of constituency projects.

Recommendations

1. Measures to Reflect the New Tax Reform Bill

- Ensure comprehensive and realistic revenue projections.

- Focus on food production and distribution to combat hunger.

- Prioritize investments in potable water, roads, and electricity.

2. Sustaining the Exchange Rate Peg at ₦1500/USD

- Build and maintain foreign exchange reserves.

- Combat corruption in fiscal and monetary systems.

- Promote domestic production to reduce reliance on imports.

3. Making the Budget More People-Oriented

- Establish Diaspora Liaison Offices for better engagement.

- Fund healthcare and industrial development projects that directly impact citizens.

- Strengthen diaspora voting rights and representation in policymaking.

4. Enhancing Government-Diaspora Engagement

- Appoint diaspora members as consultants on key projects.

- Foster regular communication through updates and town halls.

- Establish diaspora think tanks to provide professional expertise.

Key Insights

- Awareness vs. Understanding: High awareness, but limited clarity on specifics.

- Trust and Skepticism: Concerns about achieving key goals due to governance challenges.

- Engagement Gaps: Diaspora seeks stronger involvement in policymaking.

- Accountability: Transparency and anti-corruption measures are essential.

Conclusion

The survey highlights the Nigerian diaspora’s interest in the 2025 Budget of Restoration and concerns about its implementation. While the budget aligns with national priorities, addressing engagement gaps, improving communication, and leveraging diaspora expertise are crucial. By fostering trust and collaboration, the government can achieve positive outcomes for all Nigerians.

Survey Responses: Over 500 participants.

Contact Information

C&M Centre for Leadership and Good Governance UK